It is almost a year now since talk about AI exploded with the launch of ChatGPT by OpenAI. Whilst most agree its potential is profound, it is still largely too early to assess its impact. However, some early results are in!!

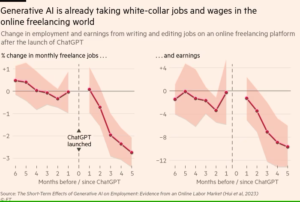

It now seems obvious that the changes being brought about by this new technology will have a greater impact on white-collar professional service jobs. The Financial Times this week looked at 2 studies on AI’s early impact on freelance writing remuneration and productivity at the Boston Consulting Group.

The first study quoted, carried out at Washington University shows a reduction in the number of freelance copywriting and graphic design jobs advertised on major freelance websites within months of the launch of ChatGPT. As well as fewer freelance jobs being advertised the remuneration for the work was reduced also.

Another study by the Harvard Business School compared 2 cohorts of consultants at the Boston Consulting Group, one carrying out tasks aided by GPT-4 and one without. The AI-assisted group of consultants completed 12% more tasks, tasks were carried out 25% faster, and were deemed to be 40% higher quality.

This seems like a bad indicator for copywriters and graphic designers and surely consultants will utilise time savings to sell more services BUT what does AI mean for finance jobs?

This is the first post in a series assessing the current and future impact AI is expected to have on finance departments and we will look at the main finance team tasks currently predicted to benefit from our robotic colleagues:

- Automation of Routine Tasks

- Data Analysis and Insights

- Fraud Detection

- Predictive Analysis

Automation of Routine Tasks

The finance task most progressed to date from an AI standpoint is the automation of routine tasks and this will be the focus of our first post in this section.

AI technologies, including machine learning and robotic process automation (RPA), can automate repetitive and rule-based tasks in accounting. This includes data entry, invoice processing, reconciliation, and other routine activities.

The idea is that this will allow accountants to spend more time on value-added activities. Less talked about is the impact that automating these tasks can have on shareholder returns. It can be a big timesaver across your operational finance function and can reduce the need for the jobs that were the first to be offshored. When implemented across large volumes of processing units the savings become worth the effort taken to implement.

What tasks can Robotic Process Automation help with?

1 Accounts Payable and Receivable

RPA can automate the tedious task of data entry by extracting information from invoices, receipts, and other financial documents. It allows for payment processes to be streamlined reducing manual effort and minimising the risk of input errors.

2 Balance Sheet Reconciliations

RPA can be employed to reconcile accounts by automatically matching transactions, identifying discrepancies, and flagging exceptions. This helps ensure accuracy and saves considerable time during the reconciliation process.

3 Expense Management

Automating expense management processes, including the validation of expenses, approval workflows, and reimbursement, can be efficiently handled by RPA. This reduces the time it takes to process expense reports and improves accuracy.

4 Financial Reporting

RPA can assist in the generation of financial reports by automating the collection and consolidation of data from various sources. This ensures that reports are produced accurately and in a timely manner.

5 Financial Planning and Analysis (FP&A)

RPA can streamline various tasks within financial planning and analysis, such as budgeting, forecasting, and variance analysis. This allows finance professionals to focus on more strategic aspects of financial management.

6 Payroll Processing

RPA can be applied to automate payroll processes, including the calculation of salaries, deductions, and tax withholdings. This reduces the likelihood of payroll errors and ensures timely and accurate salary disbursements.

7 Bank Reconciliation

RPA can assist in automating bank reconciliation processes by comparing transaction records between a company’s books and bank statements. This helps identify discrepancies and ensures financial records are up to date.

8 Tax Compliance and Reporting

RPA can streamline tax-related processes, including data collection for tax filings, ensuring compliance with tax regulations, and automating routine tasks associated with tax reporting.

Implementing RPA – What are the challenges?

While Robotic Process Automation (RPA) offers numerous benefits to finance departments, there are also challenges associated with implementing and managing RPA programs. Some key challenges include:

1 Complexity of Processes

Finance processes can be complex and involve a variety of rules, exceptions, and dependencies. Implementing RPA for intricate processes may require significant effort in understanding and mapping these complexities accurately.

2 Integration with Legacy Systems

Many finance departments still rely on legacy systems that may not be easily compatible with RPA technology. Integrating RPA with existing systems can be a challenging task, requiring additional time and resources.

3 Data Quality and Variability

RPA systems heavily depend on the quality and consistency of data. If the data sources are inconsistent or if there are variations in data formats, it can lead to errors and inefficiencies in the automation process.

4 Change Management

Implementing RPA often involves changes to existing processes, and employees may face resistance to these changes. Proper change management strategies are crucial to ensure a smooth transition and acceptance of RPA among the workforce.

5 Scalability Issues

Scaling RPA programs can be challenging, especially if the initial implementation is not designed with scalability in mind. Finance departments need to plan for the future growth of the RPA program to avoid issues as the volume of automated tasks increases.

6 Security Concerns

Automation of financial processes involves handling sensitive and confidential data. Ensuring the security of this data is paramount. Finance departments must implement robust security measures to protect against potential breaches and unauthorized access.

7 Regulatory Compliance

Finance departments are subject to various regulations, and RPA systems must be designed and configured to comply with these regulations. Failure to adhere to compliance standards can result in legal and financial consequences.

8 Skill Gap

The successful implementation and maintenance of RPA systems require personnel with the right skill set. There may be a shortage of skilled professionals who understand both the finance domain and RPA technology, leading to a potential skill gap.

9 Cost of Implementation

While RPA can lead to cost savings in the long run, the initial implementation costs can be significant. Finance departments need to carefully evaluate the return on investment and ensure that the benefits justify the expenses.

10 Continuous Monitoring and Maintenance

RPA systems need continuous monitoring and maintenance to ensure they function correctly. Over time, changes in processes, systems, or regulations may require adjustments to the RPA implementation.

Conclusion

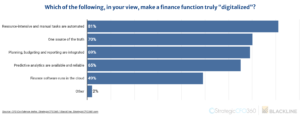

Changes in relation to Artificial Intelligence had already been underway within finance teams before the release of ChatGPT. Some processes that are described as AI and RPA are essentially something that accountants have been using for many decades – macros so this transformation has been ongoing.

Whilst it is definitely changing the way we work I have yet to see any studies about loss of jobs or salaries being impacted by the latest round of technological improvements we call artificial intelligence.