Intercompany accounting refers to the process of managing financial transactions and

relationships between different entities within the same corporate group or organization. In a

corporate group consisting of multiple subsidiaries, intercompany transactions occur when

goods, services, or financial resources are exchanged between them. Intercompany

accounting aims to accurately record and reconcile these transactions to ensure that the

financial statements of each entity and the consolidated financial statements of the entire

group are accurate.

The difficulty with Intercompany Accounting is that transactions need to show in some group

entities but not in others. Accountants need to apply a bit of creative thinking to get around

this issue and not in a dodgy creative accounting manner. NetSuite gets around this issue by

using Elimination Subsidiaries and automatically generated accounts to eliminate

intercompany transactions on elimination.

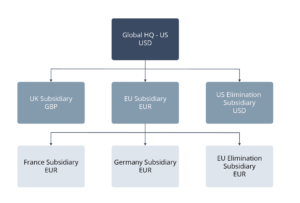

Elimination Subsidiaries

Elimination subsidiaries are sort of dummy NetSuite subsidiaries that sit alongside the legal

entity subsidiaries in your chart of accounts. NetSuite will post an elimination journal into this

subsidiary when you run the Eliminate Intercompany Transactions process as part of your

month-end period close checklist. The elimination journal will eliminate any intercompany

transactions where you ticked the Elimination box. Any FX differences based on timing are

posted to the Cumulative Translation Adjustment-Elimination (CTA-E) account.

An elimination subsidiary is required at each level in your group hierarchy, thus allowing

elimination to take place at each level. You need to create elimination subsidiaries as the

first step before you enable the Automated Intercompany Management Feature.

They are not actual subsidiaries and do not count as subsidiaries from a NetSuite license

point of view. Only journal entries can be posted to elimination subsidiaries – you are not

able to raise invoices in them for example.

Configuring NetSuite Automated Intercompany Management

Automated Intercompany Management is available with One World subscriptions only and needs to be set up when implementing NetSuite. The

feature automates a lot of the NetSuite intercompany configuration steps, including:

- Creating your cumulative translation adjustment accounts (CTA-E). These are the

accounts used for posting automated elimination journals and fix differences. - Adding the Eliminate Intercompany Transactions step is to the period close checklist. This step creates elimination entries in the elimination entity as part of the consolidation process.

- Adding the eliminated box for posting elimination lines to Standard and Advanced Interco journal lines. Ticking this box will select these lines for the automated elimination process when closing the period.

- The Eliminate Intercompany Transactions box is added to the account record. This allows these accounts to be selected for Eliminate Intercompany Transactions.

- NetSuite automatically creates the representing vendor and customer records for each subsidiary.

You can configure intercompany accounting in NetSuite without the AIM module but this is a

more complicated process and is not covered in this blog post. Reach out to us if you would

like to discuss configuring NetSuite Intercompany accounting without using AIM.

Creating Ledger Accounts

As part of your chart of account design, you should be creating intercompany accounts.

Typically, you will want intercompany receivables and/or payables for each subsidiary that

transacts with each other. Intercompany accounts need to be configured to Eliminate

Intercompany Transactions.

You may also want intercompany revenue and expense accounts if you want to identify

revenue and expenses from intercompany parties separately. You need to consider how you

want to report and analyse recharges and allocations between entities and this should inform

your intercompany accounts setup. Whilst not technically intercompany accounts these

should be given to these accounts during setup.

Cumulative Transaction Adjustment Elimination (CTA-E) accounts are added to your chart of

accounts by NetSuite when you first run the elimination process.

Intercompany Customers and Vendors

Do you intend to invoice between group subsidiaries for goods and services? If so, you will

need intercompany customers and/or vendors in each transacting entity. If a US subsidiary

intends to sell goods to a UK and DACH subsidiary, you will need customer records for

both subsidiaries in the US books. Likewise, you will need a vendor account for the US

subsidiary in the DACH and UK subs. Using these accounts allows for the elimination of

intercompany transactions when the running period ends.

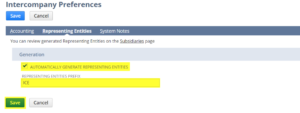

Intercompany customers and vendors are known as representing entities and can be set up

automatically using the automated intercompany management feature set out above. Use

the prefix IC or something similar when setting up vendor and customer names to make it

easier to identify intercompany entities in drop-down menus.

If you don’t use AIM you can set up representing vendors and customers manually. Once

created they are viable on the subsidiaries page under the setup menu.

This post gives an introduction to the Automated InterCompany Management feature in

NetSuite and details the steps you need to follow to configure intercompany using this

feature. Our next post on this topic will show you how to use AIM for intercompany accounting.

If you’d like to learn more about configuring Intercompany Accounting in

NetSuite or other NetSuite benefits then please contact us using the form below for a free conversation with one of our

consultants.